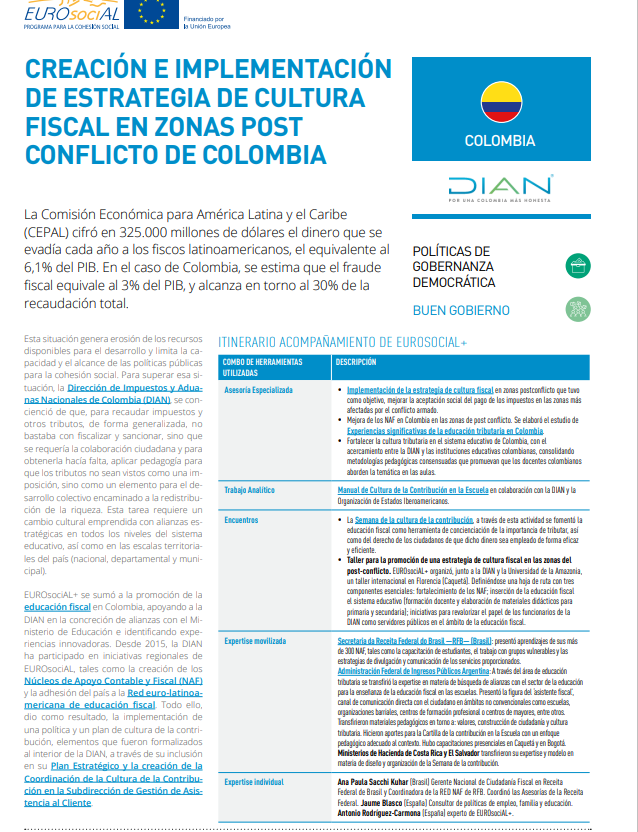

Creation and implementation of a tax culture strategy in post-conflict areas of Colombia

Publication date: 09/05/2022The Economic Commission for Latin America and the Caribbean (ECLAC) estimated the money that was evaded annually from Latin American treasuries at 325,000 million dollars, the equivalent of 6.1% of GDP. In the case of Colombia, it is estimated that tax fraud is equivalent to 3% of GDP, and reaches around 30% of total revenue.

Categories

Type document: Results FrameworkCoordinator:

Language: Spanish

Series:

Number:

Topic: Results Framework

Country: Latin America

Area: Democratic governance policies

Keyword:

SDG: Quality education, Partnerships for the goals